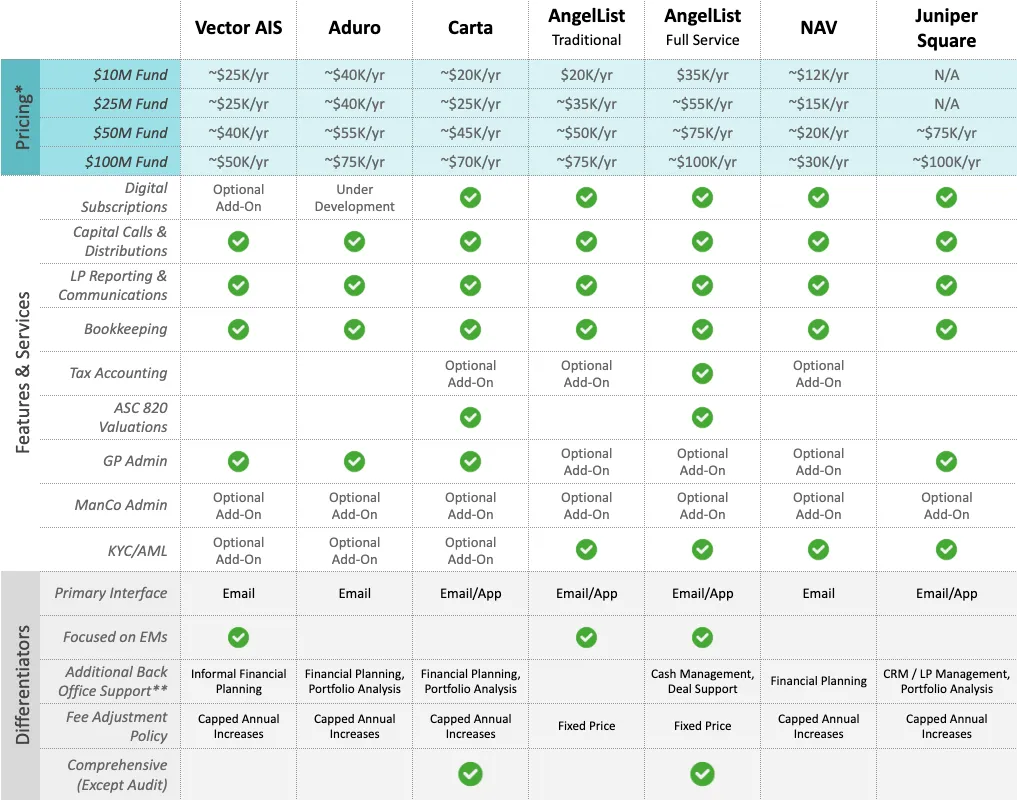

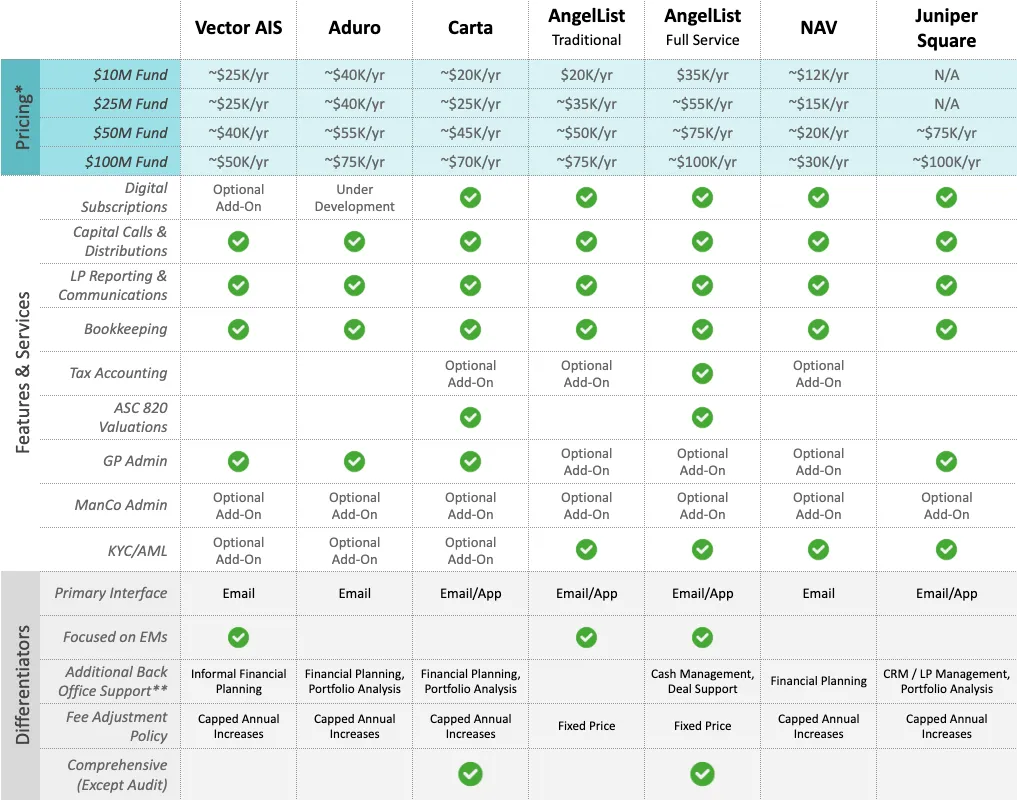

Teel Lidow just posted his take on the best admins for venture funds in the $10M-$100M range, based on his experience as fund counsel for more than 50 emerging VCs, and conversations with many more. Check it out.

Teel Lidow just posted his take on the best admins for venture funds in the $10M-$100M range, based on his experience as fund counsel for more than 50 emerging VCs, and conversations with many more. Check it out.

Coolwater Capital is doubling down on its mission to support the next generation of emerging fund managers.

Coolwater Capital is the leading platform for emerging VCs to launch, fundraise, and institutionalize with confidence. Coolwater’s accelerator is designed to make fundraising more efficient, connect GPs to top-tier LPs, and build lasting firm infrastructure.

Over the past five years, Coolwater has refined every aspect of its program—curriculum, structure, and community—into a rigorous experience that delivers real outcomes. While the program is centered on fundraising, Coolwater places equal emphasis on helping you build a firm designed to scale over time. This is where you learn the playbook, refine your edge, and co-build your venture firm alongside peers and leaders from across the capital stack.

Interested in applying? Mail info(@)coolwatercap.com and mention David Teten referred you.

Why Coolwater Capital?

Proven Track Record

We’ve helped launch 300+ VC funds that have collectively raised over $5B. More than 50 of our alumni have gone on to close second funds.

Unmatched Network Access

Tap into our proprietary network of 3,000+ LPs—including family offices, endowments, pension funds, HNWIs, and global institutions—through curated programming, events, and our managed community.

Expert-Led Training

Our accelerator includes content from 300+ select domain experts and institutional LPs, equipping you with the knowledge and frameworks needed to raise and manage a fund successfully.

Alumni Community & Ongoing Support

Our support doesn’t end when the cohort wraps. Graduates of the program stay connected through ongoing education sessions, curated events, co-investment opportunities, and peer-to-peer knowledge sharing. We continue to invest in building an engaged, collaborative network of fund managers committed to growing together.

Diversity & Inclusion

Coolwater is proud to back a diverse community: 25% of our GPs have female partners, and 46% have partners from underrepresented backgrounds.

We’re proud to support the next wave of great investors. Let’s build the future of venture—together!

A friend from UTI International shares this with me:

We are pleased to invite you to join our second India Immersion Trip, taking place in Mumbai from 16th to 19th November 2025.

This exclusive trip is designed for investment professionals to gain deeper insight into India’s economy, financial markets, and cultural backdrop through interactions with a broad range of distinguished speakers and thought leaders. We believe this immersive experience will offer a valuable, first-hand perspective on India’s ongoing transformation and future potential.

(The speakers in the last immersion trip included the Chief Economic Advisor, former SEBI Chairman, CEOs of portfolio companies, and members of our investment team)

Participants are requested to arrange their own flights, and we are happy to assist with visa requirements if needed. Once in India, you will be our guest, with accommodation and meals provided by us. Please let me know if you can attend, I am happy to provide more information as it becomes available.

Contact: sameer.agarwal(@)utifunds.com

Brief Firm Background:

UTI Investments Background: Formerly known as the Unit Trust of India, the firm is the oldest and one of the largest asset managers (USD 250 billion in AUM) in India. We are a listed company in India and T Rowe Price is the single largest shareholder at ~23%. Some of the interesting strategies (all are focused on India) managed by the firm are i) India Quality Growth strategy: quality-growth equities strategy (55-60 stocks, ~10% turnover, ~USD 4.5bn in AUM, estimated capacity of ~USD 8bn) ii) India Innovation strategy: a highly concentrated “spicy growth” equity strategy (focused on innovation growth, 22-25 stocks), iii) traditional fixed income, iv) private credit strategy.

SuperVenture North America is back in New York this November!

200+ attendees. 75+ influential LPs. 100+ industry leading VCs.

Build new partnerships with leading LPs from North America venture capital’s most influential and fastest-growing firms, with AXIAN Group, Nationwide Ventures, New Jersey Economic Development Authority, NF Trinity Limited, Omidyar Network, Rabobank and many more already confirmed to attend.

Book now and save. Free for LPs.

Remember to quote VIP code FKR3637VVC for 10% off!

Where AI, data, and expertise converge

Join leaders from Google, Stripe, UBS, Accenture, Carlyle, Johnson & Johnson in Brooklyn for three days of real-world AI playbooks, leadership lessons, and hands-on demos. Headliners include Nick Saban on building winning teams, and a fireside chat with former Goldman Sachs Chairman & CEO Lloyd Blankfein and AlphaSense founder/CEO Jack Kokko.

Save your spot with 15% off: Register through this link to claim your discount → [Register now]

I hope you’ll join other family offices and impact investors in Manhattan, during Climate Week, at the Transformative Ventures Family Office Meta Gathering/Impact Summit:

Sept 25-26: Transformative Ventures Family Office Meta Gathering

This is the final call for applications to our private investor convening. We have only a handful of spots left for family offices, philanthropists, and impact investors ready to collaborate on systems-level change.

Apply Here: https://lu.ma/mh7sk6n5

Sept 27-28: The Transformative Impact Summit

Join the global ecosystem of changemakers, innovators, and leaders for two days of unparalleled connection and collaboration in NYC.

Get In-Person Tickets: https://lu.ma/uj11ezkm

Can’t be in NYC? You can still be part of the experience! Join us online through our official live stream of all mainstage talks and panels.

Register for the Live Stream: https://luma.com/1imje3rq

Build First and Company Ventures are hosting a half-day, in-person workshop in New York City on Thursday, September 19, from 1–5 p.m. called Vibe Coding for VCs.

This program is designed for venture investors and operating partners who want to get closer to the code behind their portfolio companies and better understand how AI is actually built.

Why it matters for VCs

Understanding the builder’s perspective is critical for investors. As AI reshapes how we work, operate, and collaborate, it will also reshape what it means to be a founder—and how VCs assess, support, and fund them. This workshop is a chance to experience that shift firsthand.

The workshop is led by Bethany Crystal, a VC-turned operator with 15 years of experience in tech. She previously worked at Union Square Ventures and Variant Fund, supporting early-stage founders across dozens of portfolio companies. As an operator, she has led strategy, community, and scaling efforts at organizations like the Uniswap Foundation, and Tech:NYC. Today she is the founder of Build First, focused on helping investors and executives gain practical fluency in AI by building.

You can register through Build First (AI-powered) or Luma (classic)

Special Offer: Use promo code TETEN20025 for $100 off registration.

Request admission

Curated by Angelo Robles—a family office advisor with over two decades of experience—alongside Alexander Galambos, a leading European family office liaison—this experience is built by families, for families.

I’m honored to be one of the speakers at this curated event. On September 15-17, you’ll experience:

We conclude (September 17th) with an extended private member luncheon at one of New York City’s finest steakhouses—an intimate, high-caliber gathering curated exclusively for our members.

Request admission

Over the course of three hours, we’ll hear directly from top family office investors as they share bold conviction plays across:

Explore the full agenda and speaker briefs here: Full Program & Speaker Details

Venture: RSM US LLP

151 West 42nd Street, 19th Fl, New York, NY 10036

4 Times Square, 19th Floor

New York, NY 10036

Join us for Global VC Demo Day in New York, where 7 selected VCs, including OrangeCollective.vc, will present to a room of institutional and HNWI prospective Limited Partner investors.

If you are an active VC currently raising—or planning to raise—LP capital in the next 18 months, or an active LP allocating to the venture capital asset class, get in touch to join us at one of our full-day Global VC Demo Day events. These will be held throughout the year in San Francisco, Los Angeles, Austin, New York, Miami, London, Dubai, and Singapore. Details: https://www.7bc.vc/events. For inquiries, contact info@7bc.vc.

LPs do not pay any fee to attend and VCs are selected only from merit to pitch or attend Global VC Demo Day.

Special thanks to our host, Brown Rudnick, and our sponsor, Zive AI.

Culture Shift Labs is convening a curated circle of family offices, other institutional investors, and AI founders for a Deal-Making Summit on September 11-12 in NYC. Admission is complimentary for qualified investors managing over $100m of family or institutional assets. If you’re interested in speaking or attending, contact us. I’m honored to chair this event.

You can see the agenda and request an invitation here.

Among our confirmed speakers, who collectively manage well north of $230b:

Foundations/Institutions

Family offices

Venture capitalists/other investors

Thought leaders

You can see the agenda and request an invitation here.

About Culture Shift Labs and the Deal-Making Summits

The Deal-Making Summit is an annual invite-only series that takes place in Silicon Valley, New York, Boston and London. These are the only Summits of their kind that curates 100-300 diverse tech executives, entrepreneurs, investors, innovators and social impact leaders in order to enable deals, collaborations and wealth creation (our mission). Over the last 11 years, we’ve enabled over $2B into the hands of entrepreneurs, executives, fund managers and non-profit leaders that attend. The Deal-Making Summit is a signature event of Culture Shift Labs, a social impact and social innovation management consultancy established in 2006.