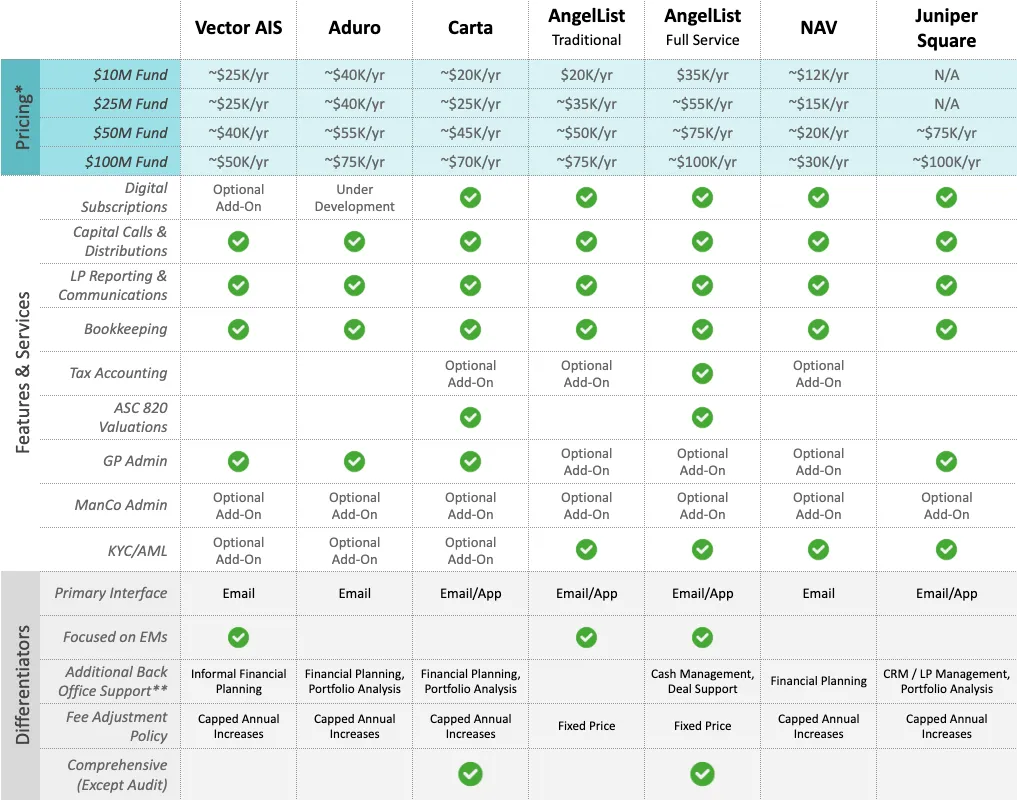

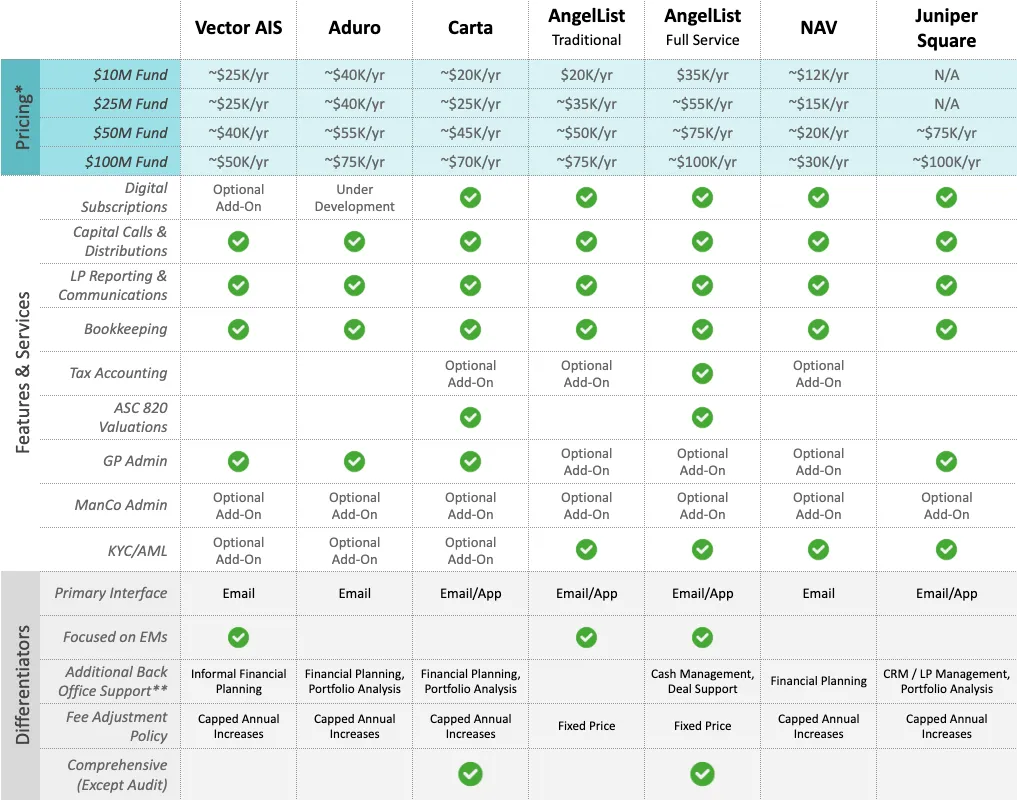

Teel Lidow just posted his take on the best admins for venture funds in the $10M-$100M range, based on his experience as fund counsel for more than 50 emerging VCs, and conversations with many more. Check it out.

Teel Lidow just posted his take on the best admins for venture funds in the $10M-$100M range, based on his experience as fund counsel for more than 50 emerging VCs, and conversations with many more. Check it out.

Hunt Club recently became a sponsor of my websites. Hunt Club enables you to recruit vetted talent, faster. We leverage our proprietary referral network of 25k business leaders to source talent proven to perform better and stay longer at companies. Clients include Bain Capital, Tiger Global, WestCap, and FJ Labs.

Darren Herman, an Operating Partner at Bain Capital, recently wrote an in-depth interview with Cammy Keiler of Hunt Club on what they’ve built, how PE/VC firms can use their technology, and how they’re filling in some of the market opportunities which Linkedin has left open for them. Check it out in Darren’s Deep Dive.

We’re partnering with Synaptic to build a detailed market map of the most popular and effective tools for investors and lenders in private markets across the entire investment lifecycle: thesis formation, origination, due diligence, fundraising, portfolio monitoring, capital deployment to fund management, marketing, accounting, etc.

Would you be interested in participating in a 30-minute interview with Synaptic about the tools you are using in your firm? All participants will receive exclusive access to the full research. The first 100 participants will be entered in a raffle for a chance to win a $100 Amazon gift card!

Here’s the video from my interview this week with Jennifer Katrulya and Rush Olney of the Family Office Association . I discuss Coolwater Capital, how family offices are investing in venture capital, and current market dynamics.

I just had a video interview with Grace Gong of Smart Venture Podcast. We talked about the tech stack of emerging managers, CRM, data & analytics in VC, career planning for aspiring VCs, and much more.

I love Yoehi Nakajima’s creativity in building Untapped Capital. Check out this deck for limited partners on the Future of AI in VC.

Real Vision just posted an interview with Kevin MONSERRAT and David Teten on the use of technology for limited partners, venture capitalists, and founders:

| We’ve been dormant during the COVID era, but are now restarting activities. If you have suggestions for events we could partner on with you, please contact us. I’ve posted recently two videos focused on how private equity and VC investors are using technology to improve returns (or suffering the consequences of not doing so): – How Private Equity and VC Investors Accelerate Portfolio Company Success – Asset Managers, Prepare to Have Your Lunch Eaten Especially during the COVID era, the main way to meet people was online. I wrote about How to Find the Right Online Communities. We posted an updated version of our white paper on VCs Eating our Own Dog Food: Using technology to make better investments. I also dove deep into An Investor’s Personal Social Media Tech Stack. Lastly, our friends at AltVia run a podcast and are seeking guests with expertise on how PE/VC investors are using technology. Contact growth(@)altvia.com . |

I recently published two articles I think will interest the AltsTech community:

– What’s Your VC Tech Stack? Results from a Survey of Early-Stage VC Funds

– The 9 Steps of Using Technology to Improve Investing in Private Companies: How Private Equity and Venture Capital Investors Are Eating Their Own Dogfood